Yes! You can use AI to fill out Form 2553, Election by a Small Business Corporation

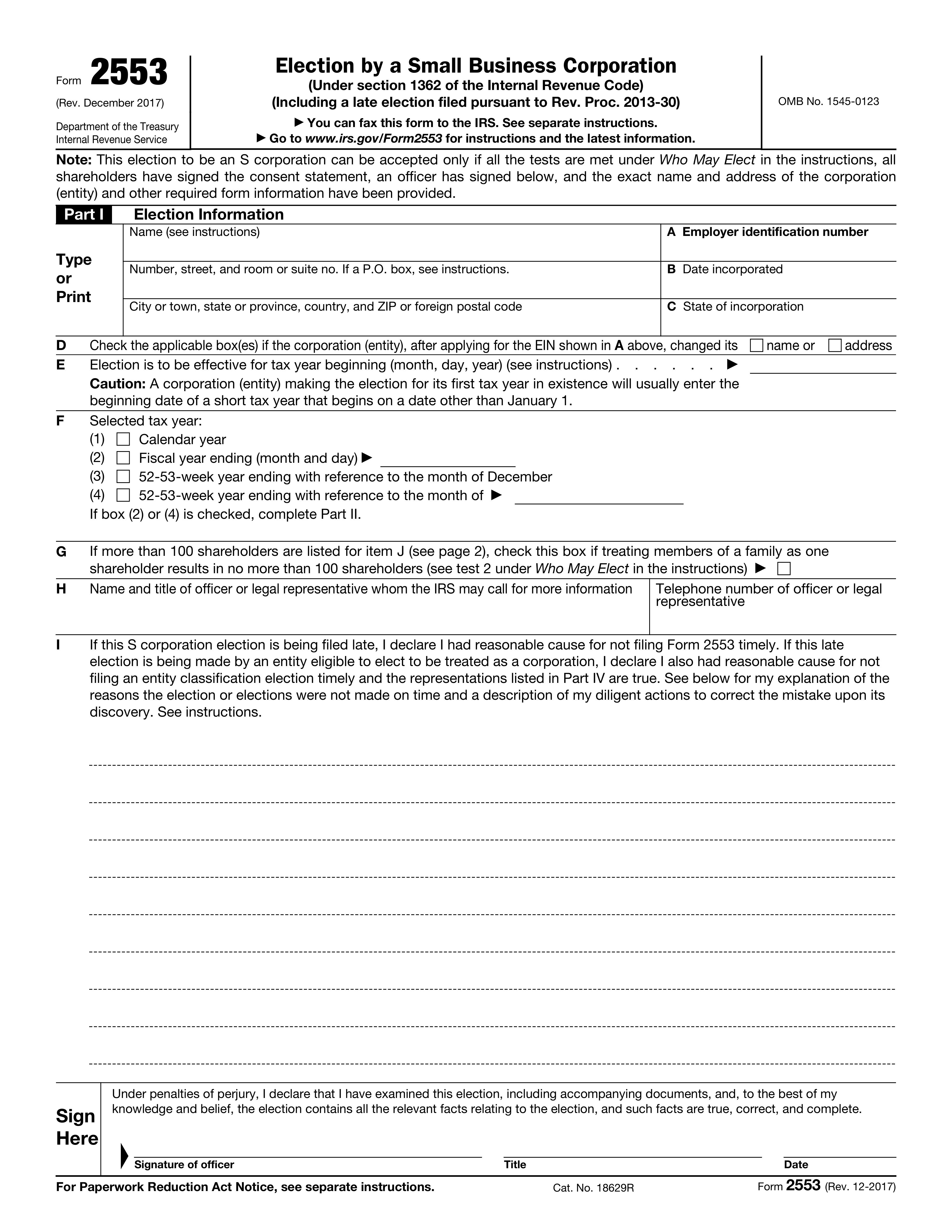

Form 2553, officially known as the Election by a Small Business Corporation, is used by eligible corporations to elect S corporation status under section 1362 of the Internal Revenue Code. This election allows the corporation to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes, avoiding double taxation on corporate income. It's important for small businesses seeking the tax benefits of S corporation status to file this form correctly and timely.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 2553 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 2553, Election by a Small Business Corporation |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 100 |

| Number of pages: | 5 |

| Version: | 2017 |

| Official download URL: | https://stinstafill.blob.core.windows.net/file-uploads/top-forms/2553.pdf?sv=2023-08-03&st=2024-08-20T08%3A48%3A52Z&se=2054-08-20T08%3A48%3A52Z&sr=c&sp=r&sig=BwTakNzJbjCwWpnRziPrMIg5oVAalO1m7LPb27DVuK0%3D |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 2553 Online for Free in 2025

Are you looking to fill out a 2553 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your 2553 form in just 37 seconds or less.

Follow these steps to fill out your 2553 form online using Instafill.ai:

- 1 Visit instafill.ai and select Form 2553.

- 2 Enter corporation's name and address.

- 3 Provide Employer Identification Number (EIN).

- 4 Select tax year and fiscal year details.

- 5 List all shareholders and obtain consents.

- 6 Sign and date the form electronically.

- 7 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 2553 Form?

Speed

Complete your Form 2553 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 2553 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 2553

Form 2553, Election by a Small Business Corporation, is used by eligible domestic corporations to elect to be treated as an S corporation for federal tax purposes. This election allows the corporation to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Corporations that meet the eligibility criteria and wish to be treated as an S corporation must file Form 2553.

The location where you should file Form 2553 depends on the state in which your corporation is incorporated or conducts business. Generally, the form should be sent to the IRS service center that serves the corporation's principal place of business or legal address. The IRS provides specific instructions and addresses for filing based on the corporation's location in the Form 2553 instructions.

Yes, Form 2553 can be faxed to the IRS. The IRS provides specific fax numbers for different types of entities and locations. It's important to refer to the most current Form 2553 instructions or the IRS website for the correct fax numbers, as they may change. Ensure that all required information is included and that the fax transmission is successful.

To be eligible to elect S corporation status, a corporation must meet several requirements: it must be a domestic corporation, have only allowable shareholders (including individuals, certain trusts, and estates but not partnerships, corporations, or non-resident alien shareholders), have no more than 100 shareholders, have only one class of stock, and not be an ineligible corporation (such as certain financial institutions, insurance companies, and domestic international sales corporations).

Part I of Form 2553 requires basic information about the corporation making the S corporation election, including the corporation's name, address, Employer Identification Number (EIN), date and state of incorporation, and the tax year the election is to take effect. Additionally, it requires the signature of a corporate officer authorized to sign on behalf of the corporation.

To indicate a change in the corporation's name or address on Form 2553, you should complete the form with the updated information. Ensure that the new name or address is clearly stated in the appropriate sections of the form. It's also advisable to notify the IRS of the change separately if the form is being submitted for a reason other than the name or address change, to ensure all records are updated accordingly.

The effective date for the S corporation election is crucial because it determines when the corporation's status as an S corporation begins. This date affects the corporation's tax obligations and benefits from that point forward. The election can be effective for the current tax year if Form 2553 is filed by the 15th day of the 3rd month of the tax year, or for the next tax year if filed after that date. It's important to choose the correct effective date to align with your tax planning strategies.

When selecting a tax year for the S corporation on Form 2553, you must choose a tax year that ends on December 31 unless the corporation can establish a business purpose for a different tax year. The selection is made in Part II of the form. If a different tax year is desired, the corporation must attach a statement explaining the business purpose for the requested tax year. The IRS must approve any tax year that does not end on December 31.

If your corporation has more than 100 shareholders, it does not qualify for S corporation status, as one of the requirements for S corporation election is having 100 or fewer shareholders. In this case, you would need to consider other corporate structures or tax elections that accommodate a larger number of shareholders. It's important to consult with a tax professional to explore your options and ensure compliance with IRS regulations.

To make a late S corporation election on Form 2553, you must file the form and include a statement explaining the reason for the late filing. The IRS may accept the late election if you can demonstrate that the failure to file on time was due to reasonable cause and not willful neglect. The statement should provide a detailed explanation of the circumstances that led to the late filing. It's advisable to consult with a tax professional to ensure that your explanation meets the IRS's requirements for reasonable cause.

The penalties for perjury related to Form 2553 can be severe, including fines and imprisonment. Perjury involves knowingly making false statements under penalty of perjury on a tax form. It's crucial to ensure all information provided on Form 2553 is accurate and truthful to avoid these penalties.

Shareholders consent to the S corporation election on Form 2553 by signing the form. Each shareholder must provide their consent, which can be done by signing directly on the form or by submitting a separate statement of consent. The consent must be filed with the IRS along with Form 2553.

In Part I of Form 2553, the following information is required for each shareholder: the shareholder's name, address, social security number (SSN) or employer identification number (EIN), the number of shares owned, and the date the shares were acquired. This information helps the IRS identify the shareholders and verify their eligibility for the S corporation election.

To complete Part II of Form 2553 for selecting a fiscal tax year, you must specify the tax year the corporation wishes to adopt. This includes indicating whether the corporation is adopting a calendar year or a fiscal year. If a fiscal year is chosen, the specific month and day the fiscal year ends must be provided. This selection must comply with IRS regulations regarding permissible fiscal years for S corporations.

A Qualified Subchapter S Trust (QSST) election allows a trust to be treated as an S corporation shareholder. To make a QSST election on Form 2553, the beneficiary of the trust must complete and sign the QSST election statement, which is then attached to Form 2553 when it is filed with the IRS. The election must include the name and address of the trust, the name and address of the beneficiary, and a statement that the beneficiary elects to be treated as the owner of the trust under the QSST rules.

For a late corporate classification election in Part IV of Form 2553, the corporation must provide representations that it intended to be treated as an S corporation from the date specified, that the failure to file timely was due to reasonable cause, and that the corporation has filed all required federal tax returns consistently with its S corporation status for the period the election is to be effective.

Yes, you can request a fiscal tax year based on a business purpose on Form 2553. The corporation must provide a statement explaining the business purpose for the requested fiscal year. The IRS will review the request and determine if the business purpose justifies the fiscal year.

A section 444 election allows an S corporation to elect a tax year that is not its required tax year, provided certain conditions are met. This election is made by completing Part II of Form 2553, where the corporation specifies the desired tax year end. The corporation must also meet the requirements for a section 444 election, including making required payments or distributions.

If you need more space to list shareholders on Form 2553, you should attach a separate sheet with the additional shareholders' information. Ensure that the attached sheet includes all the required information for each shareholder, such as name, address, and number of shares, and clearly indicates that it is a continuation of the shareholder list from Form 2553.

The latest instructions and information for Form 2553 can be found on the official IRS website. The IRS provides detailed instructions, updates, and guidance for completing Form 2553, including any recent changes to the form or the election process. It's recommended to review these instructions carefully before submitting the form.

Compliance Form 2553

Validation Checks by Instafill.ai

1

Verifies that the form is filed at the correct address or fax number based on the corporation's principal business location.

Ensures that the Form 2553 is submitted to the appropriate IRS address or fax number, which is determined by the corporation's principal business location. This validation is crucial for the timely processing of the form. It prevents delays or rejections due to incorrect submission channels. The AI software cross-references the corporation's location with the IRS's filing instructions to confirm accuracy.

2

Ensures that all tests under 'Who May Elect' are met, including the requirement that all shareholders have signed the consent statement and an officer has signed the form.

Confirms that the corporation meets all eligibility criteria outlined in the 'Who May Elect' section of Form 2553. This includes verifying that every shareholder has provided their consent to the election by signing the consent statement. Additionally, it checks that an authorized officer of the corporation has signed the form, affirming the corporation's intent to elect S corporation status. This step is vital for ensuring the election's validity and compliance with IRS regulations.

3

Confirms that the exact name and address of the corporation, along with the Employer Identification Number (EIN), date of incorporation, and state of incorporation, are accurately provided in Part I.

Validates the accuracy of the corporation's identifying information as entered in Part I of Form 2553. This includes the corporation's exact legal name, current address, Employer Identification Number (EIN), date of incorporation, and state of incorporation. Ensuring this information is correct is essential for the IRS to process the election without issues. The AI software cross-checks this data against the corporation's official records to prevent discrepancies.

4

Checks if the corporation has indicated any changes in name or address after applying for the EIN.

Verifies whether the corporation has experienced any changes in its name or address since obtaining its Employer Identification Number (EIN). If such changes have occurred, the AI software ensures that they are accurately reflected in Form 2553. This step is important for maintaining up-to-date records with the IRS and avoiding potential communication or processing errors. The software prompts for updates if discrepancies are detected.

5

Validates that the effective date of the election for the tax year is specified and the correct tax year type (calendar year, fiscal year, or 52-53-week year) is selected.

Ensures that the effective date of the S corporation election is clearly specified on Form 2553. It also confirms that the correct tax year type—whether calendar year, fiscal year, or 52-53-week year—is selected, based on the corporation's accounting practices. This validation is critical for determining the start of the S corporation status and ensuring accurate tax reporting. The AI software checks for consistency between the selected tax year type and the corporation's fiscal records.

6

Ensures that, if applicable, treating members of a family as one shareholder results in no more than 100 shareholders.

The validation ensures that when family members are treated as a single shareholder, the total number of shareholders does not exceed the limit of 100. This is crucial for maintaining the small business corporation status under the IRS regulations. It checks the shareholder count meticulously to prevent any discrepancies that could affect the corporation's eligibility. This step is vital for ensuring compliance with the S corporation requirements.

7

Verifies that the name and title of an officer or legal representative whom the IRS may contact for more information, along with their telephone number, are provided.

This check verifies the presence of a designated officer or legal representative's name, title, and contact information. It ensures that the IRS has a direct point of contact for any inquiries or further information regarding the form. The validation confirms the accuracy and completeness of this information to facilitate smooth communication. It is essential for the IRS to have reliable contact details for any necessary follow-up.

8

Confirms that, if filing a late election, a declaration of reasonable cause for not filing Form 2553 timely and an explanation are provided.

The validation confirms that a declaration of reasonable cause and an explanation are included when filing a late election. This ensures that the IRS understands the circumstances that led to the delay in filing. It checks for the completeness and clarity of the explanation to justify the late submission. This step is crucial for the IRS to consider the late election under special circumstances.

9

Ensures that the form is signed and dated under penalties of perjury.

This check ensures that the form is properly signed and dated, acknowledging the penalties of perjury. It verifies the authenticity and commitment of the signatory to the information provided. The validation confirms that the signature and date are present to meet legal requirements. This step is fundamental for the form's validity and the signatory's accountability.

10

Checks that Part II is completed if selecting a fiscal tax year, including any necessary representations or elections.

The validation checks that Part II of the form is fully completed when a fiscal tax year is selected. It ensures that all necessary representations or elections related to the fiscal tax year are accurately provided. This step is crucial for corporations opting for a fiscal tax year different from the calendar year. It confirms the completeness of the form to avoid any processing delays or issues with the IRS.

11

Verifies that the form is completed in its entirety, with no sections left blank unless explicitly allowed by the instructions.

Ensures that every section of Form 2553 is filled out completely, adhering to the instructions provided. It checks for any omissions or blank fields that are not permitted, ensuring the form's completeness and accuracy. This validation is crucial for the form's acceptance and processing by the IRS. It also confirms that any sections left blank are in compliance with the instructions, allowing for exceptions where applicable.

12

Ensures that the form is submitted within the required timeframe, considering any extensions or special circumstances.

Confirms that Form 2553 is submitted within the IRS's specified deadlines, taking into account any extensions or special circumstances that may apply. This validation is essential to ensure the election's validity and to avoid any penalties or rejections due to late submission. It also verifies that any requests for extensions or special considerations are properly documented and justified, ensuring compliance with IRS regulations.

13

Confirms that all accompanying documents and statements required by the instructions are attached.

Verifies that all necessary documents and statements, as specified in the Form 2553 instructions, are included with the submission. This ensures that the IRS has all the required information to process the election by a Small Business Corporation. It checks for the completeness and relevance of the attached documents, ensuring they meet the IRS's requirements. This step is crucial for the smooth processing and acceptance of the form.

14

Validates that, if applicable, a Qualified Subchapter S Trust (QSST) election under section 1361(d)(2) is made in Part III.

Ensures that if the situation applies, a Qualified Subchapter S Trust (QSST) election is properly made in Part III of Form 2553. This validation checks for the correct completion of Part III, confirming that all necessary information regarding the QSST election is accurately provided. It is crucial for ensuring that the election meets the specific requirements set forth by the IRS, facilitating the proper classification and taxation of the trust.

15

Ensures that, if applicable, representations for a late corporate classification election are made in Part IV.

Confirms that if the circumstances require, representations for a late corporate classification election are accurately made in Part IV of Form 2553. This validation ensures that any requests for late elections are properly documented and justified, in accordance with IRS guidelines. It checks for the completeness and accuracy of the information provided in Part IV, ensuring that it meets the specific requirements for a late election. This step is essential for the IRS to consider and process the late election request appropriately.

Common Mistakes in Completing Form 2553

An incorrect or missing Employer Identification Number (EIN) is a frequent error when filling out Form 2553. The EIN is crucial for the IRS to identify the business entity making the election. To avoid this mistake, ensure that the EIN provided matches exactly with the one issued by the IRS. Double-check the EIN on any correspondence received from the IRS or on the EIN confirmation letter. If you're unsure about your EIN, contact the IRS directly for verification before submitting the form.

Failing to meet all the 'Who May Elect' tests is a common oversight that can invalidate the S corporation election. These tests include requirements related to the number of shareholders, types of shareholders, and the type of stock issued. To prevent this mistake, thoroughly review the eligibility criteria outlined in the IRS instructions for Form 2553. Ensure your corporation meets all the specified conditions before proceeding with the election. Consulting with a tax professional can also help verify your corporation's eligibility.

Missing or incorrect shareholder consents can lead to the rejection of the S corporation election. Each shareholder must consent to the election, and their consent must be accurately documented. To avoid this issue, ensure that all shareholders have provided their consent in writing and that these consents are correctly attached to the Form 2553. It's advisable to use the consent statement provided in the IRS instructions or consult with a tax advisor to ensure all consents are properly executed and documented.

Providing an incorrect or missing corporation name and address is a mistake that can cause delays or rejection of the S corporation election. The name and address must match exactly with the information on file with the IRS. To avoid this error, verify the corporation's name and address using the EIN confirmation letter or any recent correspondence from the IRS. If there have been any changes, ensure that the IRS has been notified prior to submitting Form 2553.

Failing to indicate a name or address change after the EIN application is a common mistake that can lead to processing issues. If the corporation's name or address has changed since the EIN was issued, this information must be updated with the IRS before submitting Form 2553. To prevent this oversight, review the corporation's current information with the IRS and file the necessary forms to update any changes. Ensuring the IRS has the most current information will facilitate a smoother election process.

A frequent error is not specifying the correct effective date of the election or omitting it entirely. The effective date is crucial as it determines when the S corporation election begins. To avoid this mistake, carefully review the instructions provided by the IRS for Form 2553, ensuring the date aligns with the intended start of the S corporation status. It's advisable to consult with a tax professional to confirm the appropriate effective date based on your specific circumstances.

Another common oversight is failing to accurately specify the type of tax year the corporation intends to adopt. This can lead to complications with the IRS and potential delays in processing the election. To prevent this, thoroughly understand the different tax year options available and select the one that best fits your business operations. Consulting with a tax advisor can provide clarity and ensure the correct tax year type is chosen.

Mistakenly treating family members as a single shareholder is a common error that can affect the eligibility and benefits of the S corporation election. Each family member must be considered an individual shareholder with their own shares and voting rights. To avoid this mistake, ensure that each family member's ownership is accurately represented and documented. Seeking guidance from a legal or tax professional can help navigate the complexities of shareholder classification.

Omitting or providing incorrect contact information for the officer or representative can lead to communication issues with the IRS. This includes errors in phone numbers, addresses, or email addresses. To prevent this, double-check all contact information for accuracy before submitting Form 2553. It's also beneficial to include multiple forms of contact to ensure the IRS can reach the appropriate person if needed.

Not declaring a reasonable cause for a late S corporation election is a mistake that can result in the rejection of the election. The IRS requires a detailed explanation and evidence of reasonable cause for elections filed after the deadline. To avoid this, prepare a comprehensive statement explaining the circumstances that led to the late filing, supported by relevant documentation. Consulting with a tax professional can help articulate a compelling case for reasonable cause.

A frequent oversight when completing Form 2553 is the omission of necessary signatures or the incorrect dating of the form. This can lead to the rejection of the election by the IRS. To avoid this, ensure that all required parties sign the form and that the date reflects when the form was actually signed. Double-check the instructions for specific signature requirements, as they can vary depending on the entity type. It's also advisable to review the form for any additional signature lines that may be overlooked.

Part II of Form 2553 is crucial for selecting the fiscal tax year, yet it is often left incomplete or filled out incorrectly. This section must accurately reflect the corporation's desired fiscal year-end. To prevent errors, carefully review the IRS guidelines on fiscal year selection and consult with a tax professional if necessary. Ensure that the chosen fiscal year aligns with the corporation's accounting practices and business needs. Incorrectly completing this part can result in unintended tax consequences and delays in processing the election.

Part III of Form 2553 pertains to the Qualified Subchapter S Trust (QSST) election, which is often either incorrectly completed or entirely omitted. This section is vital for trusts that are shareholders in the S corporation. To avoid mistakes, thoroughly understand the requirements for a QSST election and ensure that all necessary information is accurately provided. Consulting with a tax advisor or legal professional can help clarify any uncertainties and ensure compliance with IRS regulations. An incorrect or missing QSST election can jeopardize the S corporation status and lead to adverse tax implications.

Part IV of Form 2553 is designated for late corporate classification elections, but it is frequently filled out incompletely or inaccurately. This section requires detailed information about the corporation's history and the reasons for the late election. To ensure accuracy, provide a comprehensive explanation and all requested details regarding the late election. It's beneficial to seek guidance from a tax professional to navigate the complexities of late classification elections. Errors in this part can result in the denial of the late election request, affecting the corporation's tax status.

A common mistake is the failure to attach all required documents and statements to Form 2553. This oversight can lead to the rejection of the S corporation election. To prevent this, carefully review the form instructions to identify all necessary attachments, such as shareholder consents and corporate resolutions. Ensure that each document is complete, accurate, and properly formatted according to IRS guidelines. Organizing and reviewing all attachments before submission can help avoid delays and ensure the successful processing of the election.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 2553 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 2553 forms, ensuring each field is accurate.